NMHC: "Apartment Market Conditions Continue to Loosen"

- Details

- Created: Sunday, 21 July 2024 15:20

- Written by Calculated Risk

Today, in the CalculatedRisk Real Estate Newsletter: NMHC: "Apartment Market Conditions Continue to Loosen"

Excerpt:

From the NMHC: From the NMHC: Apartment Market Conditions Continue to Loosen, Though Deal Flow Increased

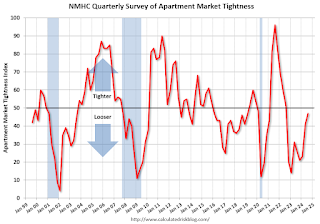

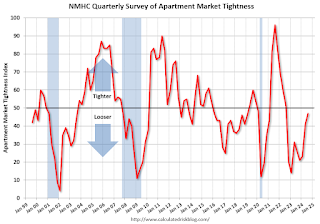

Apartment market conditions came in mixed in the National Multifamily Housing Council’s (NMHC’s) Quarterly Survey of Apartment Market Conditions for July 2024. While the Debt Financing (63) and Sales Volume (57) indexes indicated more favorable conditions this quarter, Equity Financing (49) and Market Tightness (47) came in below the breakeven level (50).

...

“Concessions have become commonplace in markets with elevated levels of deliveries, as survey respondents reported overall looser market conditions for the eighth consecutive quarter,” noted NMHC Economist and Senior Director of Research, Chris Bruen.

...

• The Market Tightness Index came in at 47 this quarter – below the breakeven level of 50 – indicating looser market conditions for the eighth consecutive quarter. Half of respondents, though, thought market conditions were unchanged compared to three months ago while 27% thought markets have become looser, down from 37% in April. Twenty-two percent of respondents reported tighter markets than three months ago.The quarterly index increased to 47 in July from 41 in April. Any reading below 50 indicates looser conditions from the previous quarter.

This index has been an excellent leading indicator for rents and vacancy rates, and this suggests higher vacancy rates and a further weakness in asking rents. This is the eighth consecutive quarter with looser conditions than the previous quarter.

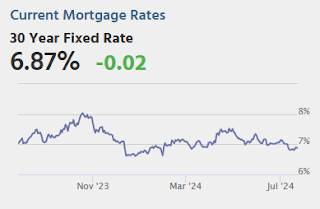

There is much more in the article. Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers

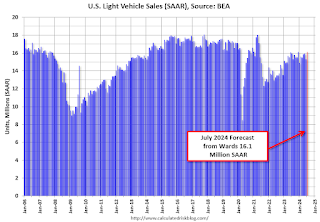

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers From WardsAuto: July U.S. Light-Vehicle Sales Tracking to Strongest SAAR So Far in 2024 (pay content). Brief excerpt:An expected boost

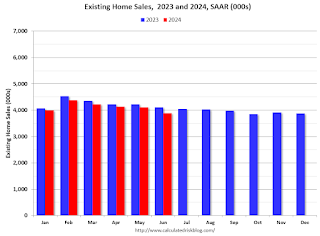

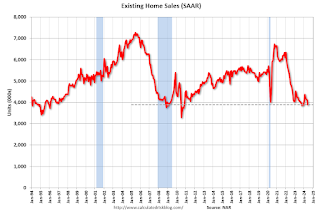

From WardsAuto: July U.S. Light-Vehicle Sales Tracking to Strongest SAAR So Far in 2024 (pay content). Brief excerpt:An expected boost Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 3.89 million SAAR in June Excerpt: Sales Year-over-Year

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 3.89 million SAAR in June Excerpt: Sales Year-over-Year From the NAR: Existing-Home Sales Slipped 5.4% in June; Median Sales Price Jumps to Record High of $426,900Existing-home sales fell

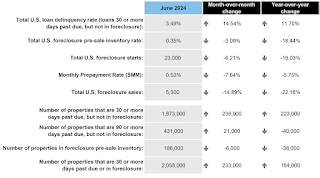

From the NAR: Existing-Home Sales Slipped 5.4% in June; Median Sales Price Jumps to Record High of $426,900Existing-home sales fell From ICE: ICE First Look at Mortgage Performance: June Sees Calendar-Driven Spike in Delinquencies; Foreclosures Remain Historically Low • Coming off

From ICE: ICE First Look at Mortgage Performance: June Sees Calendar-Driven Spike in Delinquencies; Foreclosures Remain Historically Low • Coming off Today, in the CalculatedRisk Real Estate Newsletter: NMHC: "Apartment Market Conditions Continue to Loosen" Excerpt: From the NMHC: From the

Today, in the CalculatedRisk Real Estate Newsletter: NMHC: "Apartment Market Conditions Continue to Loosen" Excerpt: From the NMHC: From the