NAR: Existing-Home Sales Decreased to 3.89 million SAAR in June

- Details

- Created: Monday, 22 July 2024 14:00

- Written by Calculated Risk

From the NAR: Existing-Home Sales Slipped 5.4% in June; Median Sales Price Jumps to Record High of $426,900

Existing-home sales fell in June as the median sales price climbed to the highest

price ever recorded for the second consecutive month, according to the National Association of REALTORS®. All four major U.S. regions posted sales declines. Year-over-year, sales waned in the Northeast, Midwest and South but were unchanged in the West.Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – receded 5.4% from May to a seasonally adjusted annual rate of 3.89 million in June. Year-over-year, sales also dropped 5.4% (down from 4.11 million in June 2023).

...

Total housing inventory registered at the end of June was 1.32 million units, up 3.1% from May and 23.4% from one year ago (1.07 million). Unsold inventory sits at a 4.1-month supply at the current sales pace, up from 3.7 months in May and 3.1 months in June 2023. The last time unsold inventory posted a four-month supply was May 2020 (4.5 months).

emphasis added

Click on graph for larger image.

Click on graph for larger image.

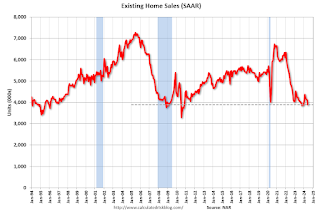

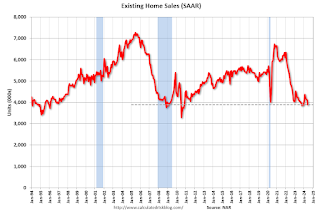

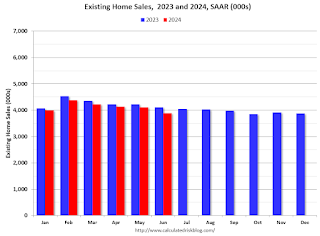

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in June (3.89 million SAAR) were down 5.4% from the previous month and were 5.4% below the June 2023 sales rate.

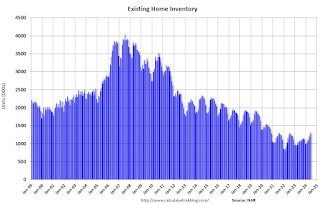

According to the NAR, inventory increased to 1.32 million in June from 1.28 million the previous month.

According to the NAR, inventory increased to 1.32 million in June from 1.28 million the previous month.

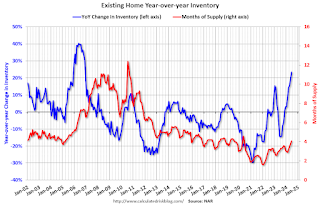

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 23.4% year-over-year (blue) in June compared to June 2023.

Inventory was up 23.4% year-over-year (blue) in June compared to June 2023.

Months of supply (red) increased to 4.1 months in June from 3.7 months the previous month.

The sales rate was lower than the consensus forecast. I'll have more later.

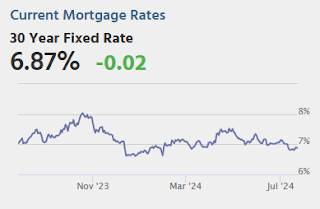

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers

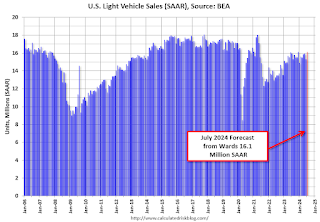

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers From WardsAuto: July U.S. Light-Vehicle Sales Tracking to Strongest SAAR So Far in 2024 (pay content). Brief excerpt:An expected boost

From WardsAuto: July U.S. Light-Vehicle Sales Tracking to Strongest SAAR So Far in 2024 (pay content). Brief excerpt:An expected boost Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 3.89 million SAAR in June Excerpt: Sales Year-over-Year

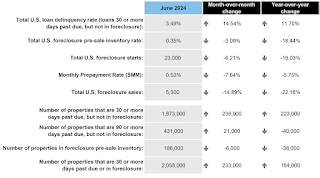

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 3.89 million SAAR in June Excerpt: Sales Year-over-Year From ICE: ICE First Look at Mortgage Performance: June Sees Calendar-Driven Spike in Delinquencies; Foreclosures Remain Historically Low • Coming off

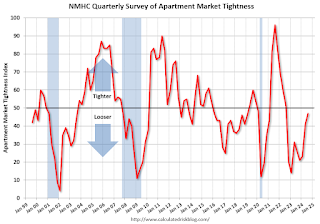

From ICE: ICE First Look at Mortgage Performance: June Sees Calendar-Driven Spike in Delinquencies; Foreclosures Remain Historically Low • Coming off Today, in the CalculatedRisk Real Estate Newsletter: NMHC: "Apartment Market Conditions Continue to Loosen" Excerpt: From the NMHC: From the

Today, in the CalculatedRisk Real Estate Newsletter: NMHC: "Apartment Market Conditions Continue to Loosen" Excerpt: From the NMHC: From the