ICE: Mortgage Delinquency Rate Increased in June

- Details

- Created: Sunday, 21 July 2024 19:21

- Written by Calculated Risk

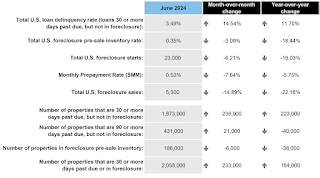

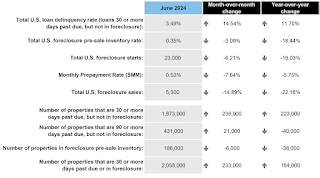

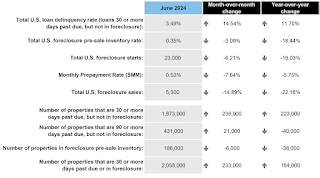

• Coming off a near-record low in May and with June ending on

a Sunday, the national delinquency rate jumped +14.5% (+45 basis points) to 3.49%, its second highest level in 18 months• Sunday month-ends often lead to sharp, but typically temporary, spikes in delinquent mortgages, as payments made on the last day of a given month are not processed until the following month

• As such, June saw a +19.6% increase in the number of borrowers a single payment past due – the highest inflow since May 2020 – while 60-day delinquencies rose 11.8% to a five-month high

• Though up 5.1% from May, serious delinquencies (loans 90+ days past due but not in active foreclosure) were still down 8.5% year over year and 10.1% below pre-pandemic levels

• Foreclosure starts declined 6.2% in June – pushing active foreclosure inventory to its lowest point since the end of COVID-era moratoriums, now 34% below pre-pandemic levels

• 5.3K foreclosure sales were completed nationally in June, representing a -14.9% month-over-month decrease to their lowest level since February 2022, still well below pre-pandemic norms

• Prepayments eased -7.6% from May, breaking a six-month streak of increasing prepay activity as we near the typical seasonal peak of home sales, and affordability and rate constraints persist

emphasis added

Click on graph for larger image.

Click on graph for larger image.

Here is a table from ICE.

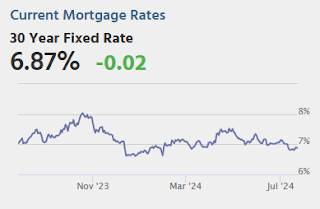

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers

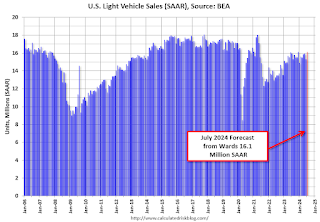

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers From WardsAuto: July U.S. Light-Vehicle Sales Tracking to Strongest SAAR So Far in 2024 (pay content). Brief excerpt:An expected boost

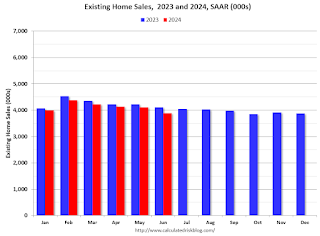

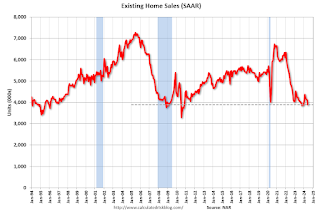

From WardsAuto: July U.S. Light-Vehicle Sales Tracking to Strongest SAAR So Far in 2024 (pay content). Brief excerpt:An expected boost Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 3.89 million SAAR in June Excerpt: Sales Year-over-Year

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 3.89 million SAAR in June Excerpt: Sales Year-over-Year From the NAR: Existing-Home Sales Slipped 5.4% in June; Median Sales Price Jumps to Record High of $426,900Existing-home sales fell

From the NAR: Existing-Home Sales Slipped 5.4% in June; Median Sales Price Jumps to Record High of $426,900Existing-home sales fell From ICE: ICE First Look at Mortgage Performance: June Sees Calendar-Driven Spike in Delinquencies; Foreclosures Remain Historically Low • Coming off

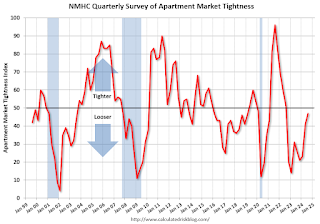

From ICE: ICE First Look at Mortgage Performance: June Sees Calendar-Driven Spike in Delinquencies; Foreclosures Remain Historically Low • Coming off Today, in the CalculatedRisk Real Estate Newsletter: NMHC: "Apartment Market Conditions Continue to Loosen" Excerpt: From the NMHC: From the

Today, in the CalculatedRisk Real Estate Newsletter: NMHC: "Apartment Market Conditions Continue to Loosen" Excerpt: From the NMHC: From the